Back

Updated at: October 31, 2025

Vertical SaaS vs. Horizontal SaaS: The 2025 Strategic Battle for Enterprise Dominance

The SaaS market in 2025 has reached a pivotal moment. According to a resounding 89% of executives and IT leaders, Vertical SaaS is the enterprise software of the future. This marks the end of the one-size-fits-all era and the beginning of a new wave of industry-specific digital transformation.

The numbers speak for themselves: the global Vertical SaaS market is projected to hit $157.4 billion by 2025, growing at a strong 23.9% CAGR. In contrast, traditional Horizontal SaaS platforms are under increasing pressure to defend their generic approach in a world where enterprises demand specialization, compliance, and tailored value.

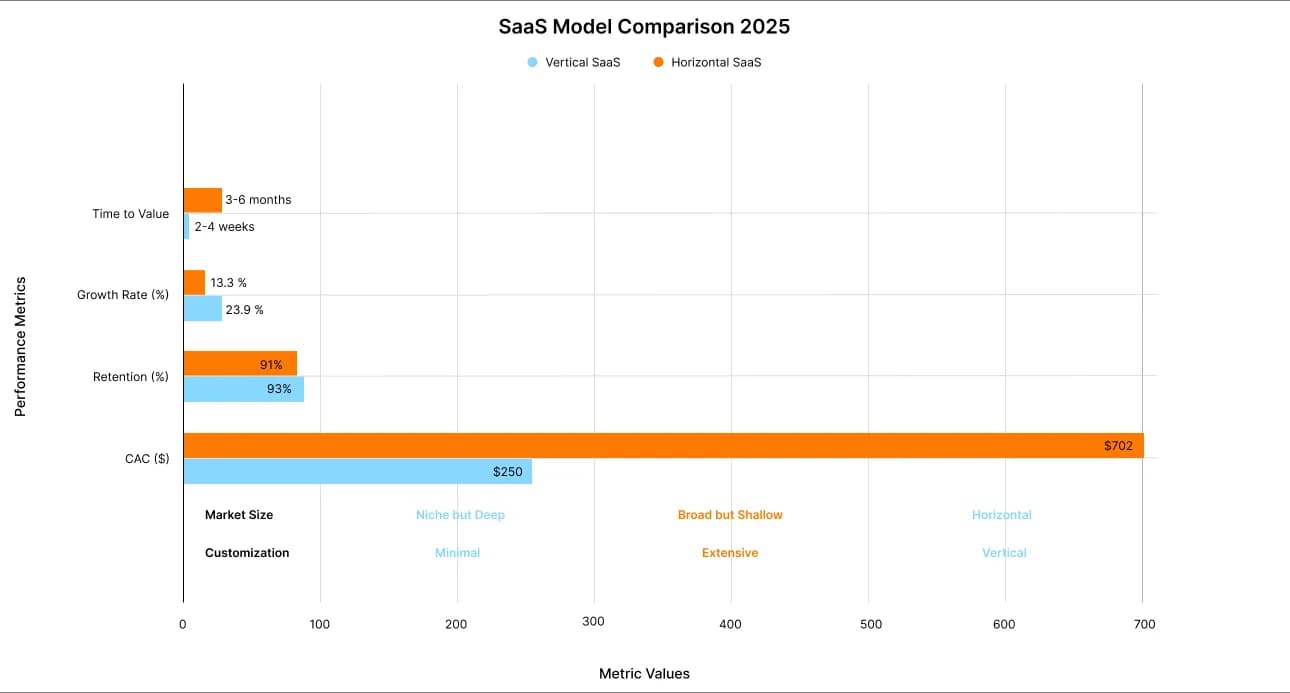

Vertical vs Horizontal SaaS: Key Performance Metrics Comparison (2025)

The economics are equally decisive. Vertical SaaS companies achieve 8x lower customer acquisition costs than their horizontal peers. When combined with higher retention rates and faster implementation timelines, this creates a structural shift in how enterprises evaluate and adopt software. For decision-makers, the message is clear: the future of SaaS is vertical.

The Fundamental Shift: From Generic to Specialized

Defining the New SaaS Paradigm

The foundation of Vertical SaaS solutions is industry specificity. They go far beyond generic tools and are made to serve industries like healthcare, construction, legal services, and financial services. These platforms' architectures incorporate specialized integrations, regulatory compliance, and in-depth domain knowledge. In a vertical platform, what would need a great deal of customization in a horizontal one comes pre-configured.

Horizontal SaaS, on the other hand, offers extensive, cross-industry functionality. Products like QuickBooks for accounting, Slack for communication, and Salesforce for CRM are made to function in practically any type of business environment. Scale is made possible by their universality, but frequently at the price of depth specific to a given industry.

The dynamics of the market demonstrate the significance of this distinction. 85% of all business applications will be SaaS-based by 2025. Yet the competitive edge increasingly belongs to specialized solutions that deliver immediate, industry-tailored value without the burden of complex customization.

The Economics Driving Specialization

The reasons why businesses are gravitating toward vertical solutions are highlighted by the economics of SaaS adoption.Customer Acquisition Cost (CAC):

- Vertical SaaS Average: $200–$300

- Horizontal SaaS Average: $702

The ability of vertical SaaS providers to precisely target their audience with messaging that speaks to industry pain points accounts for this 8x cost advantage. Because of this, they may spend up to 50% less on sales and marketing than horizontal providers do in relation to revenue.

Lifetime Value and Retention:

- Vertical SaaS Gross Revenue Retention: 93%

- Horizontal SaaS Gross Revenue Retention: 91%

- Vertical SaaS Churn: under 6% in many verticals

- Horizontal SaaS Churn: ~12%

The result is clear: vertical SaaS companies build stronger customer relationships, achieve superior retention, and sustain long-term revenue growth. For enterprises, this combination of economic efficiency and stickiness makes vertical SaaS not just a tactical choice, but a strategic imperative.

Industry-Specific Adoption Patterns: US vs. Europe

Healthcare SaaS: Leading the Vertical Revolution

The world's most developed vertical SaaS market is healthcare. SaaS accounts for 61% of the healthcare cloud software market, and 84% of healthcare organizations currently use cloud services. Strict regulatory compliance requirements that render horizontal solutions inadequate are driving adoption, which is growing at a 20% annual rate.

The centre of this change is now North America. Vertical SaaS adoption is most prevalent in the US healthcare market in:

- Electronic Health Records (EHR/EMR): By integrating compliance-driven features, businesses such as DrChrono and eClinicalWorks dominate.

- Medical Billing: With solutions tailored to the industry, providers like Kareo Billing and Waystar simplify revenue cycle management.

- Telehealth: During the pandemic, purpose-built platforms saw a sharp increase in usage and are still growing at a rapid pace.

In contrast, adoption in Europe is gradual but consistent. SaaS providers set themselves apart through GDPR compliance and an understanding of cross-border healthcare data regulations, while large EU healthcare enterprises report AI adoption rates of 41%. Here, regulatory expertise is more important than functionality in terms of competitive advantage.

Financial Services: The High-Stakes Vertical

Financial services represent the largest vertical SaaS sector, generating $25.6 billion in global revenue and employing over 133,000 professionals worldwide. With its complex regulatory environment, this industry makes vertical specialization essential rather than optional.

Key Financial Metrics:

- Fintech SaaS LTV: $11,700

- Fintech SaaS CAC: $2,496

- LTV:CAC Ratio: 5:1

Fintech companies in the US are leading the way in Banking-as-a-Service (BaaS) and embedded finance. Businesses such as Square, Plaid, and Stripe serve as examples of how specialised SaaS platforms have the power to completely transform entire markets. The push for data-driven transformation is evident in the fact that over 25% of IT budgets in US financial services are currently devoted to AI initiatives.

The emphasis is different in Europe. In this case, compliance-first methods are given priority in adoption strategies. Regulatory reporting, risk management, and international payment processing are the areas of expertise for vertical SaaS providers.Adoption is accelerating: EU financial services SaaS penetration jumped from 8.0% in 2023 to 13.5% in 2024, marking a turning point in enterprise strategy.

Construction and Real Estate: Traditional Industries Going Digital

Even the most traditional industries are now being reshaped by Vertical SaaS. Adoption in the real estate and construction sectors has accelerated significantly in 2025, with platforms such as Procore establishing the benchmark for sector-specific expertise. Instead of depending only on incremental feature development, vertical leaders are pursuing strategic acquisitions to expand capabilities, as demonstrated by Procore's acquisition of Unearth Technologies.

ROI Case Study – Construction SaaS:

- Implementation Speed: Deployments take 2–4 weeks, compared to 3–6 months for horizontal alternatives.

- User Adoption: Over 85% of employees onboard within the first month of rollout.

- Operational Efficiency: Companies report 30–40% reduction in project delays, thanks to specialized scheduling and resource management features.

The result is clear: Vertical SaaS doesn’t just digitize traditional industries — it transforms their operational DNA. By combining speed, adoption, and measurable ROI, it creates new competitive benchmarks for sectors that historically lagged in digital transformation.

Advanced CAC/LTV Benchmarks by Industry Vertical

Industry-Specific Performance Metrics

The 2025 data shows that SaaS economics vary dramatically across industries, undermining the old assumption that generic benchmarks can be applied universally. Instead, each vertical tells its own story:

High-Performance Verticals – where efficient economics fuel rapid scaling:

- AdTech SaaS: LTV $6,800, CAC $956, Ratio 7:1

- Design SaaS: LTV $5,800, CAC $895, Ratio 6:1

- Entertainment SaaS: LTV $4,080, CAC $612, Ratio 6:1

Moderate-Performance Verticals – balancing high customer value with elevated acquisition costs:

- Cybersecurity SaaS: LTV $15,500, CAC $3,441, Ratio 5:1

- EdTech SaaS: LTV $7,100, CAC $1,431, Ratio 5:1

- FinTech SaaS: LTV $11,700, CAC $2,496, Ratio 5:1

Challenged Verticals – where scaling is difficult due to thin margins and high acquisition costs:

- Business Services SaaS: LTV $2,400, CAC $787, Ratio 3:1

- Industrial SaaS: LTV $10,800, CAC $3,175, Ratio 3:1

The lesson is clear: vertical specialization dictates economic performance. Some industries reward precision targeting and compliance-driven value propositions; others present structural challenges that require new go-to-market models.

Regional Variations in CAC Performance

North America sets aggressive benchmarks:

- Enterprise SaaS CAC Range: from $2,190 (eCommerce) to $14,772 (FinTech)

- SMB-focused solutions: expected payback in <12 months

- Mid-market solutions: expected payback in <18 months

Europe demonstrates a different picture:

- SaaS providers show 10–15% higher CAC efficiency in regulated industries, where compliance expertise becomes a differentiator.

- But in less regulated sectors, CAC is 20–25% higher due to market fragmentation and localization requirements across EU countries.

For global SaaS leaders, this means success depends not only on choosing the right vertical but also on tailoring strategies by region.

Analytical Insight: CAC/LTV as the New Battleground

The variability of CAC/LTV ratios across verticals and regions highlights a fundamental reality of the 2025 SaaS market: there are no universal benchmarks anymore. Instead, customer acquisition efficiency has become the new battleground where vertical SaaS providers are gaining ground over their horizontal peers.

- Verticals with compliance-heavy environments (healthcare, fintech, cybersecurity) show superior retention and predictable revenue streams, justifying higher CAC.

- Verticals with fragmented or commoditized markets struggle to achieve scale, forcing providers to rethink pricing, go-to-market, and even partnership strategies.

- Regional differences further amplify these dynamics, making local expertise and regulatory mastery as important as technology itself.

For executives and investors, this means that CAC/LTV performance is no longer just a financial metric — it is a strategic signal. It shows where SaaS providers are building sustainable models and where business fundamentals remain fragile. Those who can balance targeted acquisition with long-term customer value will define the next generation of SaaS winners.

ROI Case Studies: Vertical SaaS Success Stories

Case Study 1: Healthcare Vertical – Athenahealth

Company Profile: A leading provider of healthcare practice management and EHR solutions, serving medical practices across the United States.

Vertical SaaS Advantages Realized:

- Average ARR per Customer: $10,500

- Revenue Mix: 97% subscription, 3% professional services

- Implementation Speed: 4–6 weeks vs. 6–12 months for horizontal EHR platforms

- Compliance Advantage: Built-in HIPAA compliance, reducing legal and IT overhead

Financial Performance:

- Customer Retention: 95%+ annual retention in core physician practices

- Expansion Revenue: 40% of new ARR generated from existing customers

- Market Position: Dominant in mid-market physician practices thanks to specialized functionality

Key Insight: Athenahealth demonstrates how regulatory compliance + vertical specialization create a sticky customer base and drive strong expansion revenue.

Case Study 2: Construction Vertical – Procore

Company Profile: A construction project management platform serving general contractors, specialty contractors, and large construction firms.

Vertical Specialization Impact:

- Industry-Specific Features: Job costing, subcontractor management, safety compliance tracking

- Mobile-First Design: 80% of interactions take place on job sites via mobile devices

- Integration Ecosystem: 400+ construction-specific integrations vs. 50–100 for generic project management tools

ROI Metrics:

- Project Completion Time: 15–20% faster through specialized workflows

- Cost Overrun Reduction: 25–30% via integrated budgeting and real-time tracking

- Safety Incident Reduction: 40% fewer incidents due to specialized safety management modules

Key Insight: Procore shows how vertical depth + mobile-first usability redefine ROI benchmarks in an industry traditionally slow to digitize.

Case Study 3: Legal Vertical – Clio

Company Profile: Legal practice management software serving law firms from solo practitioners to mid-size organizations.

Vertical Advantage Quantified:

- Time-to-Value: Firms achieve productivity in 1–2 weeks vs. 2–3 months for horizontal practice management tools

- Billing Accuracy: 95%+ accuracy in legal billing vs. 70–80% for generic platforms requiring customization

- Bar Association Partnerships: Built-in state bar integrations, impossible for horizontal platforms to replicate

Business Results:

- Client Retention: 90%+ annual retention

- Revenue per User: $3,600 ARR per legal professional

- Market Penetration: 35% share of the cloud-based legal practice management market

Key Insight: Clio proves that time-to-value and industry-native partnerships are decisive for capturing market share in specialized professional services.

Сase studies conclusion

Together, these cases illustrate a clear pattern: Vertical SaaS consistently delivers faster adoption, higher retention, and superior ROI compared to horizontal alternatives.

The AI-Enhanced Vertical SaaS Advantage

AI Specialization Creates Unbridgeable Moats

Artificial intelligence, but not in its broadest sense, is the next frontier in SaaS differentiation. Industry-specific datasets are used by AI-powered vertical SaaS platforms to provide automation and insights that horizontal providers just cannot match. Because of the defensible moats created by this specialisation, the vertical provider's competitive position is strengthened with each new piece of information.

Retail AI Performance

- 76% of retail businesses using AI-driven vertical SaaS report substantial ROI.

- Customer Engagement: 40–60% uplift in personalization effectiveness.

- Inventory Optimization: 30–50% reduction in stockouts and overstock situations through demand forecasting models fine-tuned for retail.

Healthcare AI Integration

- Diagnostic Accuracy: 25–35% improvement in outcomes when leveraging healthcare-specific AI models.

- Administrative Efficiency: 40–50% cost reduction from automating manual processes such as claims management.

- Regulatory Compliance: Automated monitoring for HIPAA and FDA compliance — functionality impossible to achieve with generic AI solutions.

Strategic Insight: When AI meets vertical specialization, it creates not only efficiency gains but also competitive barriers that widen over time. Businesses that use vertical SaaS with embedded AI are investing in industry-native intelligence that keeps increasing in value rather than merely purchasing software.

Strategic Implications: The Platform vs. Point Solution Decision

The Horizontal SaaS Defensive Response

Traditional horizontal SaaS providers are under pressure — and their responses highlight the difficulty of defending against vertical specialization.

- Vertical-Specific Feature Development

- Salesforce has launched industry-focused clouds like Health Cloud and Financial Services Cloud.

- Microsoft now offers vertical solutions for healthcare, retail, and manufacturing.

- Challenge: retrofitting a horizontal platform with vertical features rarely matches the depth of purpose-built vertical SaaS.

- Salesforce has launched industry-focused clouds like Health Cloud and Financial Services Cloud.

- Acquisition-Driven Verticalization

- Oracle spent $28.3 billion acquiring Cerner to enter the healthcare market.

- ServiceNow has invested in building industry-specific workflows.

- Result: outcomes are mixed, with many efforts slowed by integration complexity and cultural misalignment.

- Oracle spent $28.3 billion acquiring Cerner to enter the healthcare market.

To put it briefly, horizontal providers are playing defence, but the domain expertise and embedded compliance of vertical-first players are difficult to duplicate through expensive acquisitions or bolt-on vertical features.

The Vertical SaaS Expansion Strategy

By contrast, vertical SaaS companies are playing offense. Rather than spreading horizontally across industries, they scale by deepening specialization and expanding adjacently.

Expansion Patterns:

- Related Verticals: Platforms like Procore move from general contractors into specialty contractors, reinforcing their ecosystem.

- Value Chain Integration: Vertical leaders extend both upstream and downstream — for example, moving from project execution into supply chain management or post-delivery services.

- Geographic Replication: Many providers perfect their model in one market before replicating internationally, ensuring scalability without losing focus.

Strategic Perspective: The battle is asymmetric. While Vertical SaaS is growing through depth, adjacencies, and value chain integration, Horizontal SaaS is defending through acquisitions and retrofits. As a result, vertical players become more resilient and more difficult to replace.

2025–2026 Strategic Recommendations

For Enterprises Evaluating SaaS Solutions

When evaluating SaaS models, enterprises need to align decisions with compliance, workflows, and ROI expectations.

Vertical SaaS Selection Criteria:

- Industry Compliance: Does the solution include built-in regulatory compliance for your sector?

- Integration Ecosystem: Are industry-specific integrations available without costly custom development?

- Domain Expertise: Does the vendor show deep knowledge of industry workflows?

- Reference Customers: Are similar organizations reporting measurable ROI?

Horizontal SaaS Justification Requirements:

- Cross-Industry Workflows: Does your function truly require industry-agnostic capabilities?

- Customization Budget: Can you afford to invest 2–3x more in customization and integration?

- Change Management: Does your organization have the resources for extensive training and adoption programs?

Strategic Insight: The general guideline for businesses is straightforward: select Vertical SaaS when specialisation adds value, and only defend Horizontal SaaS when scale and standardisation outweigh the costs of customisation.

For SaaS Vendors and Investors

The investment logic is shifting: in 2025–2026, vertical SaaS markets represent some of the most attractive opportunities.

Vertical SaaS Investment Thesis:

- Market Size: Prioritize industries with $10B+ addressable markets.

- Regulatory Moats: Target highly regulated sectors, where compliance builds natural switching costs.

- Workflow Complexity: Focus on industries with unique processes resistant to standardization.

- Digital Maturity: Enter sectors ready for cloud adoption but still underserved by current SaaS solutions.

Success Metrics to Track:

- Time-to-Value: Vertical SaaS should deliver customer value within 30 days.

- Feature Adoption: At least 80% of core features should be adopted within 90 days.

- Reference Development: Every new customer should become referenceable within 6 months.

Strategic Perspective: For investors and vendors, vertical SaaS is about building industry infrastructure, not just software. The speed at which solutions integrate into crucial workflows and compliance frameworks will be used to gauge success in addition to ARR.

The Future of Enterprise Software: Specialized vs. Generalized

Market Consolidation Trends

The 2025–2026 outlook points to continued polarization of the SaaS market:

- Vertical SaaS Growth: On track to exceed $200B by 2027.

- Horizontal SaaS Maturity: Growth slowing to single digits in most mature categories.

- M&A Acceleration: Horizontal providers increasingly acquiring vertical specialists to compensate for slowing organic growth.

Technology Convergence Factors

The integration gap that once favored horizontal platforms is closing fast:

- APIs and Integration Platforms now enable seamless data flow between specialized vertical tools.

- Low-code/no-code platforms allow organizations to build custom integrations, reducing dependency on horizontal providers for connectivity.

- Edge Computing and Industry 4.0 applications require deep industry expertise that generalized platforms cannot deliver, giving vertical players an edge in manufacturing, logistics, and industrial sectors.

Conclusion: The Strategic Choice in Enterprise Software

The evidence is decisive: Vertical SaaS consistently outperforms horizontal platforms when enterprises seek transformational outcomes rather than incremental efficiency gains. With 8x lower customer acquisition costs, higher retention rates, and dramatically faster time-to-value, vertical solutions offer structural advantages that customization alone cannot bridge.

But the choice is not entirely binary. The most successful enterprises in 2025 adopt a hybrid architecture:

- Vertical specialists for industry-specific functions such as compliance, operations, and customer-facing workflows.

- Horizontal platforms for generic processes like accounting, HR, or internal communications.

There is an obvious strategic imperative: companies that rely on largely horizontal SaaS ecosystems will lag behind rivals who use specialised platforms to achieve higher levels of customer satisfaction, operational efficiency, and compliance.

As 2025 draws nearer, the main concern is no longer whether Vertical SaaS will expand; that is a given. The question is whether Horizontal SaaS can change fast enough to stay relevant in an increasingly demanding, specialised, and regulated enterprise market. Specialisation, not generalisation, is the way of the future.

However, each company's journey to SaaS transformation is distinct. Selecting the appropriate platforms is only one aspect of success; another is matching them with your personnel, procedures, and long-term goals.

Partnership is more important to us at We Can Develop IT than prescription. While making sure your horizontal platforms continue to function dependably, we collaborate with your teams to determine where vertical SaaS solutions add the most value. The result is an ecosystem tailored to your business — one that grows with you, adapts with you, and creates measurable value at every step.

Let’s shape your SaaS journey together — with trust, clarity, and a focus on what truly matters for your business.

Summary:

The SaaS market is undergoing a significant transformation as enterprises increasingly favor Vertical SaaS over Horizontal SaaS. A large majority of executives and IT leaders believe that Vertical SaaS represents the future of enterprise software, driven by the demand for industry-specific solutions that offer tailored value. The Vertical SaaS market is projected to experience substantial growth, while traditional Horizontal SaaS platforms face pressure to adapt to this shift. Vertical SaaS companies benefit from lower customer acquisition costs and higher retention rates, resulting in stronger long-term relationships with clients. Specialized solutions in sectors like healthcare and financial services exemplify the advantages of Vertical SaaS, as they integrate compliance features and industry expertise that generic platforms struggle to match. The approach of vertical providers focuses on deepening specialization and expanding into adjacent markets, contrasting with Horizontal SaaS, which often relies on acquisitions to enhance their offerings. The dynamics of customer acquisition and lifetime value metrics illustrate that vertical specialization is becoming a crucial factor for SaaS success. As the market evolves, companies are advised to align their software strategies with industry-specific needs and workflows. The future of enterprise software will likely see a hybrid approach, where Vertical SaaS addresses specialized functions while Horizontal SaaS covers more generic processes. Ultimately, the ability to navigate this changing landscape will determine which SaaS providers excel in meeting the demands of their customers.

Read also:

VerticalSaaS

HorizontalSaaS

SaaSmarket

enterprise

2025

digitaltransformation

industryspecific

compliance

specialization

customization

healthcare

construction

legalservices

financialservices

QuickBooks

Slack

Salesforce

customeracquisitioncost

LTV

retention

NorthAmerica

Europe

GDPR

AI

FinTech

Stripe

Plaid

Square

Procore

Clio

Athenahealth

EHR

telehealth

medicalbilling

ROI

AdTech

Design

Entertainment

Cybersecurity

EdTech

BusinessServices

IndustrialSaaS

CAC

LTVratio

regulations

investors

hybridarchitecture

platforms

APIs

lowcode

edgecomputing

Industry4.0